Once again I am returning to specialty distributors (for me a fascinating ecosystem). This time the report is about Wesco International (WCC), one of the largest North American industrial distributors, offering electrical, industrial, and communications products and services.

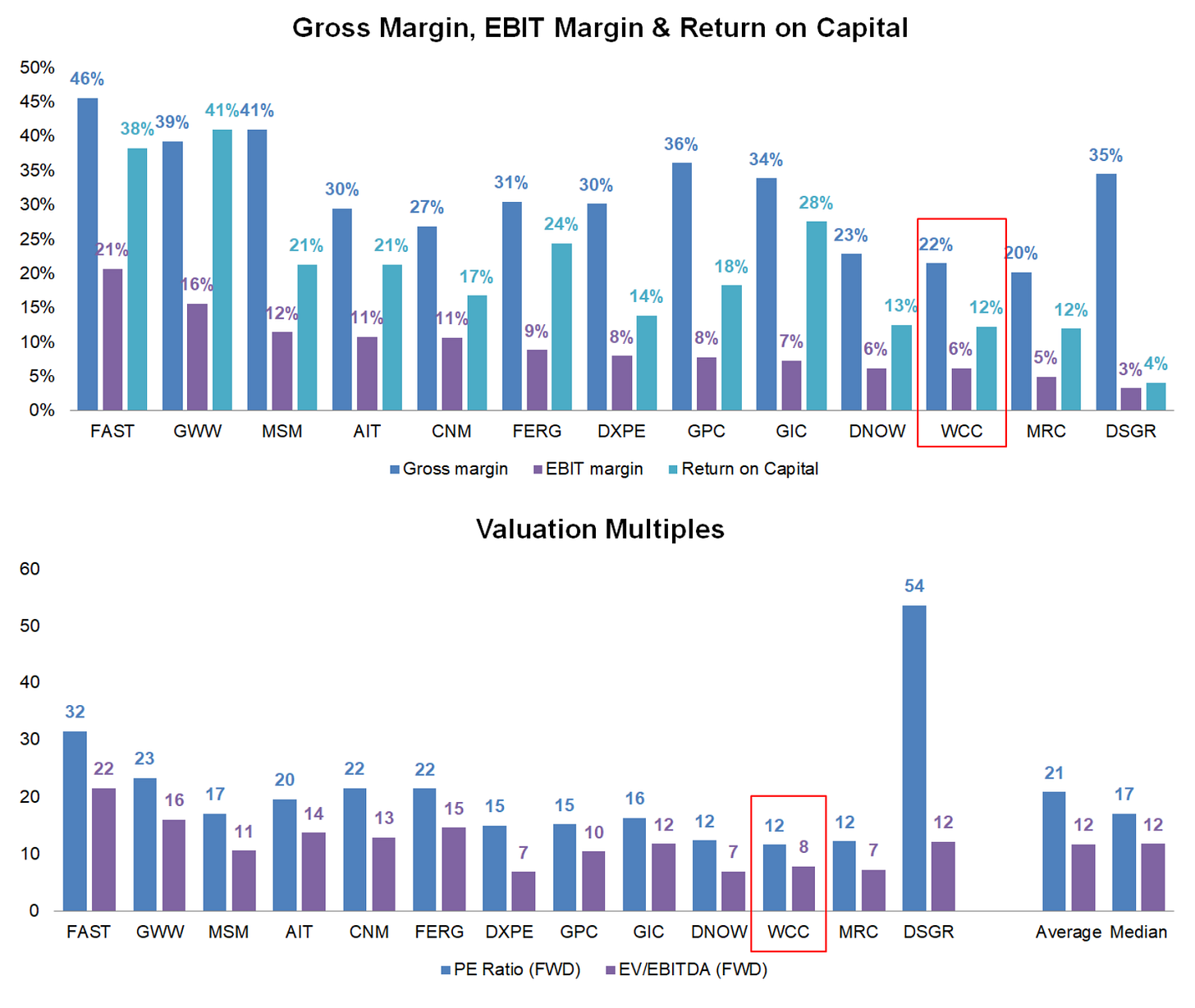

However this time it is a little bit different. I usually find that these specialty distributors always seems expensive, trading at multiples well above the ones that could be considered as “reasonable” for an average company, even though it is commonly for a good reason, which is the quality and trajectory of those companies. In the case of Wesco, the Company is not trading with a premium over the market and indeed it is the opposite. Let’s have a look to the following charts (ordered from left to right by operating margin):

As it can be observed, Wesco is trading with a discount with regard to its peers and this is probably because the market considers its business to be of lower quality. I do think that this is a misperception and Wesco’s business possesses many characteristics that make it to be a really interesting business, especially after its merger with Anixter (more info below). Let’s dive into the analysis of those characteristics, starting with the business model itself.

(If you think those posts are useful, please let me know by clicking the like button or sharing with anyone that you think could find it helpful. It is the only way for me to know that this is valuable)

Business Model

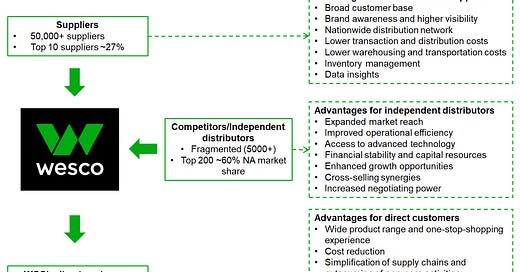

As is the case of some of the other greatest distributors (e.g. POOL, WSO, BLD, SITE, GMS), Wesco has been able to create a business model that capitalizes on its role as a distributor to enhance the supply chain efficiency for various of its stakeholders, including suppliers and customers:

The advantages that Wesco provides to its stakeholders are similar to those that the best distributors provide in other industries:

In relation to suppliers, Wesco is able to connect suppliers with a large and diverse customer base, helping them access markets that might be difficult to reach independently; increases their exposure and brand recognition through its extensive distribution network; handles distribution and logistics, allowing suppliers to focus on production and innovation without the burden of managing complex supply chains; can offer suppliers reduced transaction costs and better economies of scale; and provides valuable market insights.

With regard to its direct customers, Wesco provides access to a wide product range and one-stop-shopping experience; ensures that products are readily available locally, minimizing lead times and improving delivery efficiency; provides expert advice and technical support; helps with inventory management, streamlining procurement and centralized ordering and billing processes; can provide better pricing conditions, thanks to bulk purchasing and economies of scale; and can extend credit and favorable payment terms, enhancing financial flexibility for customers.

With regard to other independent distributors (i.e. acquisition pipeline), Wesco provides several compelling benefits to potential acquirees: expanded market reach, with immediate access to a larger geographic footprint and enhanced market position; improved operational efficiency and cost synergies; access to advanced technology, such as data analytics and digital platforms; greater capital resources and financial stability to expand the scale; better growth opportunities; cross-selling synergies; increased negotiating power, etc.

As it will be discussed further in the following paragraphs, we are again in front of a company that creates some sort of virtuous cycle where all the stakeholders have incentives to work with them and where all those benefits get reinforced as the distribution network grows, increasing the incentives of suppliers, customers and independent distributors to join the organization.

Anixter Merger and Competitive Advantages

In 2020 Wesco merged with Anixter International (AXE), creating the largest North American electrical distributor. Till then, Wesco was focused mainly on providing electrical distribution and supply chain services. The combination with Anixter has strongly increased its products and services offering, with the expansion to data communications, security solutions, and wire & cable distribution, and its geographical reach, thanks to Anixter global footprint.

Although the market seems to be still cautious with the integration of the two companies (which is reflected in its valuation), the new Wesco is a much better company that enjoys several competitive advantages:

Diversified business model.

While overlapped in some areas, Wesco and Anixter are rather complementary businesses, and Anixter acquisition has broadly expanded Wesco's offerings across wire and cable, data communications and network and security solutions. The combined entity can offer an ample range of products and services, potentially increasing customer retention and capturing a larger market share. Besides it has improved the business mix reinforcing its presence in faster-growth and higher-margin end markets.

Additionally it has extended Wesco’s customer base and geographical scope. Anixter’s global presence complements Wesco’s North American strength, enhancing international reach and diversifying revenue streams, and this diversification will help mitigate risks associated with any single product line, sector or region.

Global footprint and scale.

Before Anixter’s merger, Wesco enjoyed an extensive national footprint with approximately 500 branches mainly located in North America and (limited) operations in 16 additional countries. However the merger almost doubled the Company’s footprint and now Wesco operates nearly 800 branches and in more than 50 countries.

This leading position provides many advantages to the new Wesco. Its products and services often need timely deliveries and this requires maintaining extensive networks and inventories close to the final customers in order to be able to offer the best lead times. In this fragmented industry this makes other competing distributors with more limited scale and presence to have serious difficulties to compete.

Besides, Wesco works with many national and global customers that prefer to deal with the same company in all the geographic areas where they have businesses. Wesco scale gives the capacity to provide a reliable and homogenous service/product quality all across the covered geographies, which is especially relevant for those large customers.

Strong market position and leading player in a consolidating industry.

In close relation with the previous point, with the merger and the absorption of one of its main competitors, Wesco has strongly reinforced its market position with regard to both customers and suppliers. It is expected Wesco to have even greater preferential access to manufacturers and key product lines and to obtain more competitive pricing compared to its competitors, making customers increasingly inclined to transact with them. This may create some sort of flywheel that will make its market position to keep reinforcing over time.

This increasingly strong market position may also serve as some sort of barrier to entry for potential new entrants, as it will be rather difficult for them to achieve the scale to compete with Wesco (i.e. obtain competitive conditions from suppliers, create an extensive distribution network, access to human capital or specific product lines, etc.).

Besides, the overall market remains highly fragmented, with many competitors with little market share. In that sense, it is expected Wesco to leverage this strong market position to keep acquiring remaining competitors and further consolidating the industry, with market share gains contributing to medium and long-term growth.

One-stop shop experience

Another positive result of the merger is that it has greatly reinforced the one-stop shop experience. As previously mentioned, Wesco has broadly expanded its products and services offering with the annexation of Anixter and “the combined portfolio creates an efficient single-source, or one-stop-shop, for all (its) customers’ needs”. Wesco provides a complete solution for its customers and this removes the burdensome task of dealing with multiple suppliers, especially for those who need small quantities of many different products.

Additionally, as supply chain integrity and resilience have recently become top concerns, customers tend to lean on distributors able to provide the most comprehensive and reliable solutions. Being Wesco’s supply base one of the largest, it is able to provide a much broader array of products and services than many of its competitors and provide customers’ solutions even during challenging times.

Cross-selling opportunities

As commented above, Wesco and Anixter are rather complementary businesses with minimal overlap between legacy customers and the merger has broadly expanded the products and services that can be offered to both Wesco’s and Anixter’s customer bases. The Company has built its cross-sell momentum during the last years and indeed it has finally been a much larger opportunity than originally envisaged. In that sense, according to the Company, cross-selling efforts are expected to drive share capture and contribute to Wesco’s above-market growth.

Additional Positive Points

Resilient business model.

Wesco generates strong free cash flow and, maybe more importantly, it is able to do it throughout the cycle, making the business resilient and counter-cyclical during the challenging moments of the economic cycle. For this kind of distributors the most relevant investments are related with working capital and both Wesco and Anixter have historically demonstrated that have the ability to play with this working capital when it is required. Specifically they master the capacity and flexibility of unloading inventory while scaling back purchases in periods of downturn.

This makes this Company a resilient business capable of successfully navigating troubled waters.

Strong balance sheet and financial stability.

In close relation with the previous point, Wesco’s strong and counter-cyclical free cash flow generation makes the Company to usually present a robust balance sheet. Besides the Company has a positive track record of managing its financial leverage and rapidly returning to its long-term leverage target ratio following any acquisition (indeed it has recently reduced the leverage ratio range from 2.0x – 3.5x to 1.5x – 2.5x).

Well positioned to accelerate growth driven by secular growth trends.

Wesco is currently structured around 3 business units: Electrical and Electronic Solutions (EES), Communications and Security Solutions (CSS), and Utility and Broadband Solutions (UBS). All of them are favorably exposed to secular growth trends:

o EES is positioned to capitalize on trends like automation, LED adoption, IoT, electrification or electrical equipment upgrades.

o CSS on data center expansion (driven by accelerating data consumption, increased adoption of cloud-based technologies, demand for data storage…), broadband, 5G, automation or IoT.

o UBS on green energy, renewables adoption, grid modernization investments, grid capacity or electrification.

Additionally Wesco is well positioned to capture the global supply chain trends like supply chain consolidation and the process of reshoring, nearshoring or relocation to North America, and the North American infrastructure investment needs and the general increase in public sector investments in infrastructures and broadband.

All these factors, together with share gains and continued industry consolidation, will probably drive Wesco’s future sales and profitability in the medium to long-term.

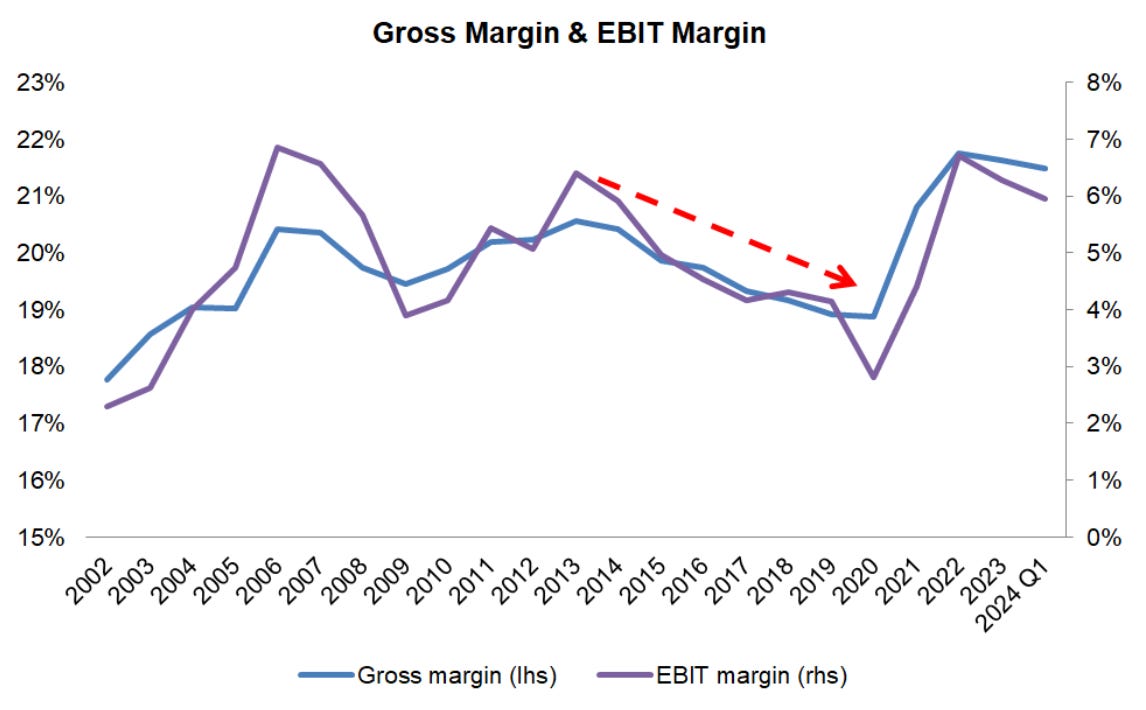

Point of Concern: Margin Expansion

One of Wesco’s key priorities and pillar of its Value Creation Engine is margin expansion. However, if we observe the evolution of its margins in the recent past the situation is not particularly promising:

The COVID-19 period created significant disruption to the economy and generally distorted margins all across sectors, and indeed it is now when we begin to observe a certain reversal to pre-pandemic levels and we are still waiting to see where margins will finally stabilize. Taking this into account, in order to better understand where the margins were heading, we can have a look at the evolution of Wesco’s margins before the pandemic and we can observe that since 2014 there was a gradual decline in its gross and EBIT margins. This was basically due to competition, business mix, and inflationary pressures and the difficulties to pass through supplier price increases.

This recent evolution is the reason to consider this as a point of concern and something to follow-up. However, there are some aspects that invite to be optimistic. First of all, the main reasons that were impacting Wesco’s margins pre-COVID (i.e. competition, pricing and business mix) have all improved. In terms of competition, the merger with Anixter has eliminated the main Wesco’s competitor and, as previously commented, its market position has strongly improved. In terms of pricing, its bargaining power has also increased and it would be expected the Company to receive more favorable supply terms resulting in lower cost structures and higher margins. With regard to business mix, the incorporation of Anixter has reinforced Wesco’s presence in faster-growth and higher-margin end markets, which is also expected to be beneficial for its profitability.

There is also another aspect that encourages me to think that the Company may be on the right path. Let’s zoom in in the previous chart and observe what was happening to Wesco’s and Anixter’s gross margins just before the merger:

We can observe that Anixter’s gross margins were also in a gradual decline but the company was able to reverse this situation in 2018 and started to improve its margins, especially compared to Wesco. This improvement was the result of a margin improvement program implemented across the company and this program is currently being deployed across the combined business. This program revolves around two ideas: “value-based pricing and solution selling playbooks”, which basically means selling more-valuable complete solutions that combine products and higher-margin supply chain services; and “accountability”, with salesforce incentive compensation aligned to incremental margins. The results of this program within Anixter were astonishing and there are no specific reasons to think that the implementation in Wesco will not be also successful (but it requires close monitoring).

Conclusion

As commented, Wesco is not the highest quality business among specialty industrial distributors. However, this is a company with a really interesting and powerful business model that makes life easier for all its stakeholders. Besides, looking through a long-term perspective, it presents many positive aspects and tailwinds:

Diversified business model, especially after Anixter acquisition.

Global footprint and scale, with national and international presence.

Strong market position and leading player in a consolidating industry.

Efficient single-source or one-stop shop experience.

Cross-selling opportunities.

Resilient business model and counter-cyclical FCF.

Strong balance sheet and financial stability.

Well positioned to benefit from secular growth trends.

Being true that there are some uncertainties regarding one of its main goals, which is margin expansion, and that it is still pending to see where margins will finally stabilize in this post-pandemic era, there are circumstances that invite to be optimistic. Many of the abovementioned tailwinds are expected to be margin accretive, as it is the implementation of Anixter’s margin improvement program.

All in all this is an interesting company, doing things well, finalizing the successful integration of Anixter’s acquisition, and trading at multiples below its peers and far from stretched.