I do really search for companies in many different sectors but there is something that eventually brings me back to specialty distributors. As I mentioned in one of my previous articles, I had always thought about distribution as a boring business and now I am completely fascinated with it.

Today I am writing about TopBuild (BLD), which is the largest installer and distributor of building insulation products in the US and Canada.

Business Model

As some of the greatest distributors (e.g. POOL, WSO or SITE), BLD has been able to create a powerful business model where all the stakeholders surrounding the Company benefit with the dynamics it generates. BLD positions itself in the middle of the supply chain making the distribution process much more efficient for all the participants: manufacturers can more easily sell their products and builders/contractors have timely access to insulation products and services, having all of them many incentives to work with the Company.

The advantages that BLD provides to its stakeholders are similar to those that the best distributors provide in other industries, but rather unique within the insulation business:

In relation to manufacturers, the insulation industry is rather concentrated and BLD, with its huge scale, provides a valuable partnership for all those high-fixed-cost-model manufactures, which are able better leverage their cost structure. Besides BLD, with its national footprint, provides immediate access to a nationwide distribution network, helping manufactures to save the costs and complexity of maintaining and managing a complex distribution business; reduces transportation costs and inventory management risk and costs; and helps to manage the direct relationship with final customers.

With regard to contractors and home builders, and thanks to its national scale and capillarity, BLD is able to provide a reliable and differentiated service (see competitive advantages in the next paragraph). Among others, it creates a one-stop-shopping experience, provides with flexible delivery options, offers building science and technical expertise, can access to better conditions thanks to its scale and can extend credit and favorable payment terms.

With regard to other independent distributors (i.e. acquisitions pipeline), BLD allows acquired businesses to keep running as separate businesses, with a completely local and decentralized approach, but at the same time provides national resources that will make branches much more efficient and realize relevant cost synergies. This includes operating best practices, access to material and labor, purchasing leverage, streamlined back office operations or national customer relationships.

As we will see in the next paragraph, BLD’s multiple competitive advantages provide many incentives for its partners to keep working with them and for other independent distributors to be keen to join the network. This creates some sort of virtuous cycle where all those advantages get reinforced as the distribution network grows, increasing the convenience for manufacturers and building contractors and making the community even more attractive for other independent distributors. In that sense we could expect BLD to keep thriving in the future, as long as the construction sector helps along.

Competitive Advantages

Apart from BLD’s efficient business model (presented in the previous paragraph), there are many other characteristics that make this company rather unique. Let’s have a look to some of them in order to better understand why BLD will probably continue outperforming in the future:

Diversified business model

BLD serves two different segments: installation and distribution. After its last acquisition in July, those segments represent approximately 54% and 46%, respectively.

Historically BLD was much more skewed to the installation business but rapidly realized about the advantages of a more balanced structure. The combination of both installation and distribution businesses allows the Company “to more effectively reach a broader set of builder customers, regardless of their size or geographic location”.

Besides the distribution business mitigates the significance of revenue cyclicality as the value proposition of this segment becomes even more attractive to contractors as the cycle trends down. Under recessionary periods there is some sort of trade down effect where large insulation contractors, which usually buy directly from manufacturers, turn to distributors like BLD looking for more flexible delivery options (e.g. less-than-full truckload). This may help to offset a decrease in demand in the installation segment because of a downturn and makes BLD a much more resilient business model.

Diversified end-markets: residential, commercial and industrial

In terms of end-markets, the Company is also well diversified:

As it can be observed, two decades ago the company was mainly devoted to the residential construction market. However nowadays it presents a greater mix of the commercial/industrial activity, which has materially increased its importance.

Although affected by many of the same macroeconomic factors, commercial/industrial has historically followed a different cycle than residential housing and has a more relevant part of the revenue coming from maintenance and repair work. This nature increases the percentage of recurring revenue and provides a buffer against a housing market slowdown, helping BLD to outperform in different economic environments. Besides commercial/industrial presents higher barriers to entry and operating margins (especially heavy commercial and industrial), making this segment even more attractive.

All in all, this end-market diversification has made BLD to become a more profitable and resilient company.

National footprint and scale

Thanks to its continuous expansion, BLD has approximately 235 installation branches located across the US and approximately 180 distribution centers in the US and Canada. Apart from the economies of scale, this geographical footprint provides two relevant competitive advantages:

The capacity to provide a homogenous service/product quality all across the covered geographies, which is especially relevant for national and regional home installers.

The capacity to rapidly move resources among different locations. Labor and material are generally tight within the industry and very critical to builders. BLD, with its national footprint and connected ERP system, is able to ship that material and labor around pretty seamlessly.

Besides, its expanding scale enables the Company to leverage its cost structure, making the Company much more efficient and profitable as it grows.

Meaningful capital allocation strategy

BLD carries out a thoughtful and disciplined capital allocation strategy where the first priority is the business itself, through internal investments and strategic acquisitions.

One of its most recognizable competitive advantages is its M&A strategy. The Company has carried out 34 acquisitions and integrations since 2016 with combined annual revenues totaling approximately $2.5 billion:

The strategy focuses on its core business (insulation) and seeks profitable and well-managed companies with solid customer bases. The idea is to keep the “acquired” management team unchanged and give them as much capacity as possible. Once acquired, BLD is able to rapidly realize cost synergies mainly through material purchasing power, branch and back office consolidation, and supply chain and operational optimization.

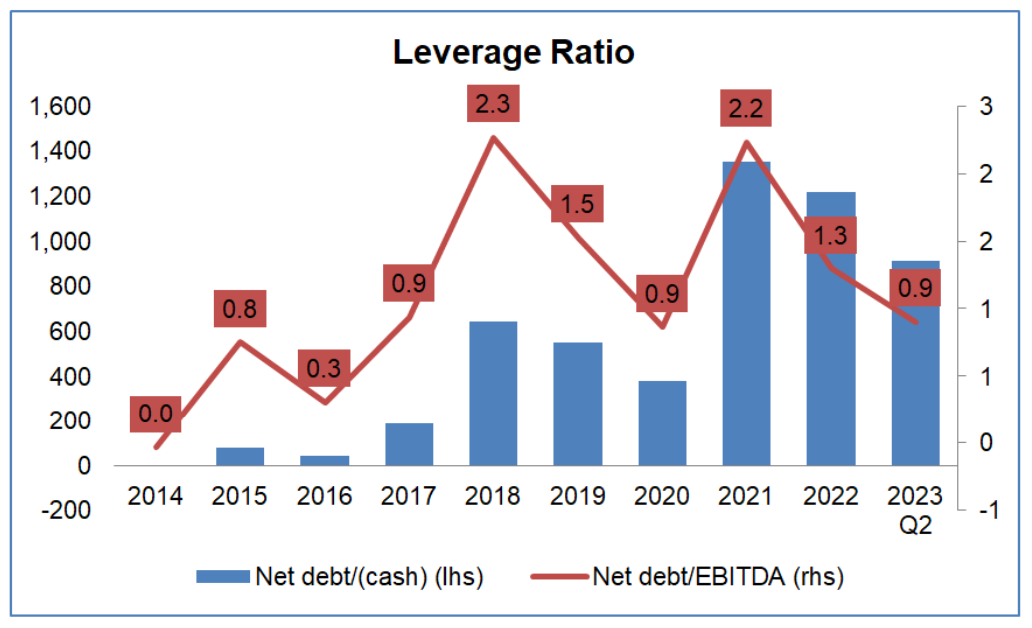

Additionally the Company keeps its debts level well under control and within the targeted leverage range between 1x and 2x TTM AEBITDA (with some bumpiness depending on the M&A activity):

Finally BLD returns any additional available capital to shareholders through stock repurchases, steadily reducing the number of shares outstanding:

Pricing power

BLD has clearly demonstrated its capacity to “push the full impact of inflationary input cost through selling price increases”. There has been material price increases almost each year since at least 2016 and the Company has been able to fully offset this cost inflation with selling price adjustments. The insulation piece of the total cost for a builder is not that large (less than 2% of the total cost of the home in the case of the residential segment) and the builders tend to be “receptive” to the increase (at least until now). Sometimes there is some lag between a material price increase and a corresponding selling price adjustment, but over time the Company has been always able to transfer the price increase.

Flexible business model

BLD shows a really interesting model in terms of flexibility and this confers the Company with the capacity to easily adapt to different economic environments.

As commented in one of the previous paragraph, BLD is rather flexible in terms of material and labor allocation across its branch network. Material and labor are rather interchangeable among branches and can be moved around (at least in the residential and light commercial spaces). All BLD branches are integrated into a core ERP system with real-time information and this allows the Company to rapidly move its resources depending on the level of activity in each geographic area.

Additionally BLD presents a rather variable cost structure (70% variable vs 30% fixed) where “material and direct labor are the largest cost components”. This structure allows the Company to leverage its fixed structure when demand increases and make adjustments quickly in case of a changing economic environment.

Besides the Company has the policy of occupying their branches and distribution facilities under leases with durations of five years or less (in 2022 the weighted-average remaining operating lease term was 4.2 years). This policy might expose BLD to some disruption in case of being unable to renew branch or distribution facilities leases, but in any case it perfectly reflects the general culture that it has been adopted by the Company since the Great Recession of being as flexible as possible in order to be ready in case of a downturn.

Long-Term Industry Tailwinds

Apart from all these positive aspects commented in the previous paragraphs, which mainly refer to the Company itself, there are many other long-term industry trends that invite to be optimistic with BDL’s future. We can analyze these industry tailwinds from two different perspectives: looking at those that impact the construction sector in general, which in turn can be breakdown into residential construction and commercial/industrial construction; and those related specifically with insulation trends.

With regard to the residential part of the business, as explained in GMS article, there is a clear housing deficit as a consequence of the significant underbuilding over the last decade (it is estimated that ~14M housing units needed to meet 2030 US demand):

Home inventory has been steadily decreasing due to limited supply of both new and existing homes, and this problem is accelerating during these days as there are many owners under the "lock-in" effect of high mortgage rates that are not willing to sell their homes (exacerbating even more the problem of home inventory). At some point the new residential construction will have to fill this gap and this will help the insulation industry to keep growing (regardless of potential short-term hurdles as a consequence of deterring interest rates or affordability issues).

With regard to the commercial/industrial construction, there are also many favorable trends that are expected to provide relevant tailwinds to the sector: de-globalization or on-shoring processes; warehouse and distribution centers development; data centers construction; “green energy” projects and energy transition processes (e.g. EV and EV battery manufacturing facilities, renewable energy projects, etc.); or the need for infrastructure improvements and favorable legislative actions (e.g. Infrastructure Investment and Jobs Act, Inflation Reduction Act, CHIPS Act, etc.). These are just some examples of the many tailwinds that can be derived from the commercial/industrial construction as all these projects will require some sort of insulation activity.

Finally with regard to the insulation sector itself, customers are increasingly worried about environmental issues and energy efficiency (it is estimated that 90% of buildings in US are under insulated and that homeowners can save an average of 11% on total energy costs by air sealing their homes and adding insulation). These concerns are pushing regulators to take specific actions to respond to these issues, mainly through the adoption of stricter energy and building codes, the upward revision of building standards and the implementation of insulation tax credits. All these sustainability actions create a long-term tailwind for the industry, as this basically means higher insulation requirements, and its relevance keeps growing year after year.

Risks or Negative Aspects

Despite the positive long-term view, there are some uncertainties that could negatively affect the Company and that require closely follow-up:

Cyclicality

Construction is a cyclical business highly affected by macroeconomic factors that are outside of the Company’s control: “In a recession or economic downturn, our customers may materially reduce construction activities because of lower consumer demand, which in turn will decrease their need for our services and the products that we distribute”. However, as explained in the previous paragraph, an economic slowdown should have a short-term impact as there are many tailwinds that are expected to make the Company to keep outperforming in the long-run.

Labor shortage

Although recently intensified, this has been a structural issue for the Company and the sector and has been affecting BLD at least during the last decade. This is one of the most relevant issues for the Company as it affects them through two different channels. There is a direct impact that comes from the difficulties that the company encounters to hire employees and the correlative wage inflation. But there is also an indirect impact that arises from the impact of this labor shortage over its customers: a labor-constrained market means lower number of construction days available and so lower projects and lower business for BLD.

However BLD has historically demonstrated its capacity to deal with this labor situation through its talent management strategy (being the “employer of choice”), finding ways of getting more productive and with a highly efficient branch management process that allows sharing labor among branches.

Potential pricing power erosion

As previously commented, BLD has been successfully adjusting its selling prices in order to offset any material price increase without affecting its demand. However it is important to recall that the last decade has been rather benign for the real estate market and BLD is pending to demonstrate if it will be able to keep passing on to customers cost increases in case of a slowdown. Indeed the Company has been warning in one of its last conference calls that they are starting to observe some impact of the current macroeconomic environment over the final consumer, while “the housing industry is still being impacted by inflationary pressures across most of the supply chain, creating an unprecedented market dynamic that will take some time to resolve”.

The way the Company has been historically able to manage its prices in response to material price changes invites to be optimistic, but it any case this is a risk to closely follow up as it could have a relevant impact in terms of operating margins.

Suppliers concentration

The Company “sources the majority of (their) fiberglass building products from four primary U.S.-based residential fiberglass insulation manufacturers: Knauf, CertainTeed, Johns Manville, and Owens Corning”. Though BLD assures that it has “positive relationships with (their) suppliers and are in continuous contact and work closely with” them, any interruption by any of the key manufacturers might have a relevant impact. However due to the importance that BLD represents for each one of these manufacturers it is unlikely any relevant interruption to occur.

Disintermediation risk

The distribution activity, whatever the sector, is always under the sword of Damocles of being disintermediated by manufacturers/OEMs. Sometimes these companies try to implement direct-to-consumer (D2C) strategies to improve their financial performance and enhance direct connections with consumers, and, nowadays, with the digital revolution and the expansion of e-commerce, this possibility is more real than ever.

The problem for these manufacturers is that distribution plays a really valuable role and many times this disintermediation makes no sense. The key is the capacity of the distributors to add value to their customers. As I think it has become clear throughout this article, BLD provides many advantages to all the stakeholders within the industry and plays a key role in the supply chain. This is the reason why I consider this is not an urgent risk, at least in the short-to-medium run, but of course is something to not disregard.

Valuation

In my opinion there is no doubt that BLD is a great company with a beautiful business model and many tailwinds that are expected to keep moving the Company (and the stock) in the right direction in the long-run. However, this is not enough. What about the current valuation? BLD has a short trading history because it operates as a separate company just since July 2015 but we can observe that it is currently trading near the bottom of the last years multiples:

Should we compare with other specialty distributors, in order to have a more comprehensive view, again BLD trades below most of its peers:

This is a slightly heterogenic list of companies where the most comparable company is IBP (check Analyzing Good Businesses for a comparison BLD vs IBP and a good BLD write-up), but all of them with similar business models to BLD and the majority closely related with the construction sector.

The stock has receded more than 23% from its ATH (from ~$307 to ~$235) but it has increased ~50% YTD. This overextended positive evolution during the year, combined with the cloudy current macroeconomic environment, invites to be cautious in the short-term. The macroeconomic environment is not the most favorable for the construction sector and there could be some activity slowdown due to the high levels of material and financial costs that currently housing and construction projects bear, together with affordability issues and confidence deterioration of the final customer. However, BLD has a powerful business model and within a sector that enjoys many long-term tailwinds, and, in my opinion, there are no specific circumstances that could make think that this company will not keep thriving in the future. In that sense it is for sure a company to keep in the watchlist and maybe look for attractive entry points.

If you enjoyed this, please consider becoming a subscriber and share with anyone that you think could find it valuable. Thank you for your support!

I’m a fan of distribution businesses as well. Have you ever checked out Encore Wire (WIRE)? I have owned it in the past but am not currently a shareholder.

Thanks for the article! Good stuff.