Introduction

Return on Invested Capital (ROIC) is one of the most relevant metrics used in the investment field and I totally agree with the importance attributed to it. However I have the feeling that frequently analysts miss the most relevant lessons that can be learned with this metric. It is rather common to observe how analysts just take the final figure and compare among different companies, with the simple conclusion that the higher the ROIC the better the company. Let me clarify that this conclusion is often true, but from an analytical perspective this is a rather superficial statement that miss many relevant lessons. The importance of the ROIC doesn’t lie (only) in the number itself but in how this number has been achieved. In other words, it is the breakdown of the ROIC what is really relevant.

This breakdown is what will allow us to really understand the business model that is behind the figure, what the company is doing right (or wrong) to achieve a specific ROIC and, even more importantly, how sustainable is that figure. Diving deeper into the ROIC will help analysts to ask the right questions and hopefully get the right answers.

But let's start by making a reminder of the concept itself. Michael J. Mauboussin and Dan Callahan have recently revisited what for me is the bible in terms of ROIC and one of their most famous articles, “Return on Invested Capital. How to Calculate ROIC and Handle Common Issues”, where ROIC is defined as follows:

Additionally they state that “understanding how a company achieves its returns can provide guidance in assessing whether they will be sustainable” and that “knowing how a company generates an attractive ROIC can inform competitive strategy analysis”. In that sense, they breakdown the previous formula into NOPAT Margin and Invested Capital Turnover:

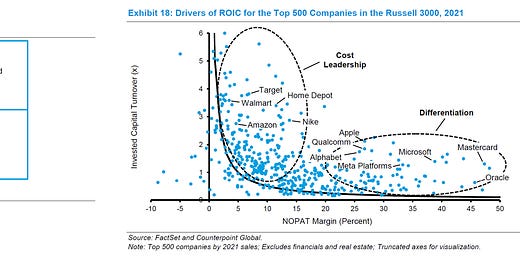

Besides they mention that “if a business gets to a high ROIC through a high NOPAT margin, you should focus your analysis on differentiation. If the company’s high return comes from a high invested capital turnover ratio, emphasize analysis of cost leadership. Rare companies have high NOPAT margins and high invested capital turnover ratios. Generally, those companies have advantages reinforced by economies of scale”, and include the following charts:

Following this idea I have reproduced a similar chart but just for companies within the industrial distribution sector:

(Note: As the idea of this article is much more qualitative than quantitative, I have used EBIT (instead of NOPAT) In order to simplify the calculation. This makes the calculation easier and homogenous among companies and doesn’t change the conclusions at all).

As we can observe in the chart there are obviously different ROIC levels within the sector, but the most interesting aspect is not those different levels but the different combinations of EBIT Margin and Invested Capital Turnover that generate those ROIC levels and how similar levels are reached with totally different combinations of these two metrics. In this article I will try to show the importance of the ROIC breakdown through the analysis of two of the most relevant industrial distributors: Fastenal and Grainger. Looking deeper on these two companies we will get a better understanding on why we should look at ROIC not as a final measure but as a starting point for further analysis.

The Case Of Fastenal

Let’s have a look to Fastenal’s case. As we can observe, Fastenal presents the second-best ROIC among all of those in the sample. Breaking down its ROIC, we can also realize that its strategy seems to be much more focused on margin than on capital turnover. In terms of margin, Fastenal has been consistently able to keep its operating margin well above its competitors:

This margin outperformance is the result of two Fastenal’s specific characteristics. The first one is its commercial strategy. Fastenal deliberately doesn’t compete on prices. Its strategy is based on providing the most convenient, closest and timely service to its customers. Its customers get so many advantages working with them that they are keen to pay an extra dollar for those products acquired from them company.

The second characteristic is its capacity to leverage operational expenses. Indeed should we analyze Fastenal’s margins evolution we can observe that during the last decade this has been the main driver to keep operating margins outperforming:

Indeed, Fastenal has been steadily reducing its gross margins as it has been shifting its product mix toward more non-fastener products (lower margins), instead of its original strategy that was focused mainly on fasteners (which is a higher-margin category due to their specialized nature). However, Fastenal has maintained profitability through operational efficiency and by focusing on value-added services like vending machines and inventory management, which has helped mitigate the margin pressure from non-fastener products.

The flip side of Fastenal’s business model is its capital intensity and so lower capital turnover. There are two key differentiators that are essential to its business model but that lead to this lower capital efficiency

One is the reliance of its sales strategy on its local branch network. The company operates over 3,400 branch locations, which serve as both retail outlets and mini-distribution centers. These branches are positioned close to customers, allowing for fast, local availability of products

The other one is inventory management services that Fastenal provides to its customers. This is one of Fastenal’s better-known differentiators: the company helps its customers to free up resources in terms of inventory stocks. The problem is that this inventory remains in Fastenal’s books until its customers effectively use it, even being onsite in customers’ locations.

All in all this is a company that prioritize margins and it is willing to bear some capital intensity because the final result is a huge ROIC, and understanding how this ROIC is achieved allows analysts to focus on FAST’s priority, which are its margins, and dive deeper in order to assess its sustainability.

The Case Of W.W. Grainger

Grainger is the company that presents the highest return on capital among the sample and, while this return is rather similar to Fastenal’s, this company follows a completely different strategy.

First of all, Grainger offers a much more extensive product catalog than Fastenal. Its strategy is more focused on providing a one-stop shopping experience across multiple industrial product categories. This in the end means that much of its inventory consists of commodity-type items that are in regular demand across various industries and which generate lower margins. Besides Grainger’s strategy involves competing more directly on price and look for high-volume sales, making the company to rank below Fastenal in terms of profitability.

Second. Unlike Fastenal, Grainger follows a much more asset-light approach. This company operates a centralized distribution model that allows it to consolidate inventory in fewer locations and maintain higher inventory turnover compared to Fastenal. This focus on operating fewer and larger distribution centers allows for better inventory control and lower overall inventory levels, and so lower requirements of capital tied up in unsold goods.

Third. Grainger follows a digital-first model, with e-commerce accounting for the vast majority of its sales. A significant portion of Grainger’s sales comes through its e-commerce platform (~80% vs ~25% in Fastenal), which further facilitates efficient inventory management, reducing the need for extensive local stockpiles and leading in the end to better capital efficiency.

In summary, while Grainger’s margins are lower due to the broader, commoditized nature of its product mix, the company is able to benefit from higher levels of capital efficiency due to its centralized distribution model and e-commerce dominance, reaching in the end even higher levels of ROIC than Fastenal.

Final Comments

As we have observed, Fastenal and W.W. Grainger are two companies working within the same sector and performing at similar levels in terms of ROIC, but working with completely different strategies. If we had taken into account only the superficial ROIC data, we would not have even begun to suspect that structural differences were hidden beneath the surface. The breakdown of the ROIC is an essential analysis in order to really understand the specificities of any company and analysts should dig deeper on this concept instead of blindly compared the final figures.

Very good article. One question, how would you calculate the invested capital? because there are many different formulas and it can even be confused with the ROCE sometimes.