Builders FirstSource ($BLDR): 8 Reasons To Love The Company (And Many Sectorial Tailwinds)

If you have followed my articles for some time, I do know that this might sound repetitive but I’m once again returning to specialty distributors. I promise I try to escape from this kind of companies (and I hope to do so) but I keep finding really interesting examples that I really think it’s worth sharing. This time I will talk about Builders FirstSource (BLDR), one of the largest US suppliers of building materials.

I started to analyze this company at the beginning of August and unfortunately the stock has appreciated almost 15% since then. However, I still think there is a lot of value in the company, especially if we think about it with a long-term perspective (anyway I will discuss this issue in a final section devoted to valuation).

As always, let’s start the analysis with the explanation of its business model.

(If you think those posts are useful, please let me know by clicking the like button or sharing with anyone that you think could find it helpful. It is the only way for me to know that this is valuable)

Business Model

BLDR manufactures, supplies and installs building products within four product categories: lumber and lumber sheet goods; manufactured products; windows, doors and millwork; and other specialty building products and services (e.g. including siding, exterior trim, metal studs, cement, roofing, insulation, wallboard, ceilings, cabinets and hardware).

Although BLDR is not a pure distributor and some of its segments are vertically integrated with manufacturing, the importance of its business model resides in its capacity to enhance the supply chain efficiency for its suppliers and customers:

The advantages that BLDR provides to its stakeholders are similar to those provided by the highest-quality distributors:

In relation to suppliers, BLDR is able to connect its suppliers with a large and diverse customer base, helping them access markets that might be difficult to reach independently; increases their exposure and brand recognition through its national distribution network; handles distribution and logistics, allowing suppliers to focus on production without the burden of managing complex supply chains; and can offer suppliers reduced transaction costs and better economies of scale.

With regard to its direct customers (i.e. homebuilders and construction contractors), BLDR helps them to reduce construction cycle times, and so their costs; mitigates labor constrains as it is capable of reducing customers’ in-site labor needs; provides access to a wide product range and one-stop-shopping experience; ensures that products are readily available locally thanks to its national distribution network, minimizing lead times and improving delivery efficiency; provides access to digital tools, expert advice and technical support; helps with inventory management, streamlining procurement and centralizing ordering and billing processes; can provide better pricing conditions, thanks to bulk purchasing and economies of scale; and can extend credit and favorable payment terms, enhancing financial flexibility for customers.

With regard to other independent distributors (i.e. acquisition pipeline), BLDR provides several compelling benefits to potential acquirees: expanded market reach, with immediate access to a larger geographic footprint and enhanced market position; improved operational efficiency and cost synergies; access to advanced technology, such as data analytics and digital platforms; greater capital resources and financial stability to expand the scale; better growth opportunities; cross-selling synergies; increased negotiating power, etc.

All in all BLDR provides so many advantages to all its stakeholders that make much less desirable for them to interact directly among themselves: manufactures don’t have many incentives to establish their own distribution networks and neither homebuilders of purchasing directly from manufacturers. The secret sauce of BLDR is that helps improving its partners’ efficiency and this hugely increases its customer stickiness (~90% customer retention rate). We are again in front of a company that creates this kind of virtuous cycle where all the stakeholders have incentives to work with them and where all those benefits get reinforced as the distribution network grows, increasing the incentives of suppliers, customers and independent distributors to join the organization.

Competitive Advantages

Having presented the business model in the previous paragraph, let's now dive deeper into all those features that make BLDR so interesting and that will probably help the Company to continue outperforming in the future:

1. Industry-leading scale and national footprint

BLDR started operating mainly in the southern and eastern U.S. but over time it has been increasing its scale through a consistent geographic expansion, combining organic and inorganic growth:

The Company currently maintains a broad network of distribution and manufacturing facilities throughout the U.S and this scale provides significant advantages that smaller competitors struggle to match:

Large-scale procurement capabilities that leads to advantageous purchasing, competitive pricing and preferential sourcing.

Operational efficiencies that allow a more cost-efficient customer service, which both enhances profitability and reduces the risk of losing customers to competitors.

Efficient inventory management across multiple locations, leading again to cost efficiency and superior customer service, and resulting in high on-time delivery rates (more on this below).

Better and more consistent service to large customers (which is increasingly important due to the trend of suppliers’ consolidation by homebuilders), as BLDR can serve those large customers across multiple geographies and projects and providing consistent customer service.

Less exposure to any one market and geographic diversification that help to better overcome cyclicality and economic disruptions occurring in different parts of the country.

2. Local market presence

Although homebuilders are increasingly consolidating their industry, homebuilding is still a business with local nature and largely dependent on local conditions, even within these larger organizations. This is because building codes and architectural styles differ significantly from one region to another. In that sense, BLDR focuses on growing local relationships and leveraging local market intelligence, and indeed two of BLDR’s crucial factors for its success are the capillarity of its network and its ability to maintain the local flexibility required to satisfy customer needs (see Efficient distribution network below), while also leveraging the advantages of being large-scale company.

3. Strong partnerships with customers

In close relation with the previous points, BLDR operates one of the largest networks of distribution centers, manufacturing facilities, and retail locations in the U.S building sector. This broad footprint enables the company to serve a wide range of customers across different regions but also to enhance customer loyalty.

The idea revolves around building deep customer relationships and making their work more efficient. BLDR is “much more than a supplier of commodity lumber” and provides its customers with many advantages:

Total cost of build reduction.

Lower construction cycle times.

Lower warehousing/inventory costs.

Labor savings and labor shortage mitigation.

Wide product range and one-stop-shopping experience.

Full and on-time deliveries.

Safer job-site environment.

Waste reduction.

All in all BLDR secret sauce lies on its capacity to help its customers solving their problems, increasing their stickiness and making them more willing to do business with the Company, and eventually to pay more for its products and services and to increase its share of wallet.

4. Efficient distribution network

As previously commented BLDR operates one of the largest networks of distribution centers, with locations throughout the U.S, and presents many specificities that distinguish them from most of its competitors, especially from the smaller ones.

This network is a consolidated platform (not a decentralized one) that has been expanded and optimized over the years based on the principle of “regional density”. The idea is as follows: within each market, BLDR creates a network of distribution centers and “manage inventory across (this) network of locations” (instead of individually DC by DC) “in order to service customers quickly, efficiently and reliably from multiple delivery points within the market”. The Company “moves products between locations to minimize working capital, eliminate redundant inventory and less rapidly restock while ensuring the customer needs are reliably met with efficiency and precision”. This strategy creates many advantages:

Optimize utilization, inventory and equipment between locations.

Improves time delivery and reliability.

Minimizes distribution costs and guards against out-of-stock items.

Leverage local market expertise and sharing of resources and administration.

Adjust to market changes and mitigate business risk.

And even more importantly, it again increases customer satisfaction and stickiness.

5. Breadth of product and service portfolio and focus on value-add

BLDR is focused in expanding its product portfolio (both organic and inorganically), and specifically its value-added products and services. BLDR doesn’t aspire to be merely a provider of materials or commodity products, but a strong partner that adds value to its customers. Those value-added products/services help homebuilders and constructors with their main pain points, improving their cost structures, home construction quality and job-sites safety, among others.

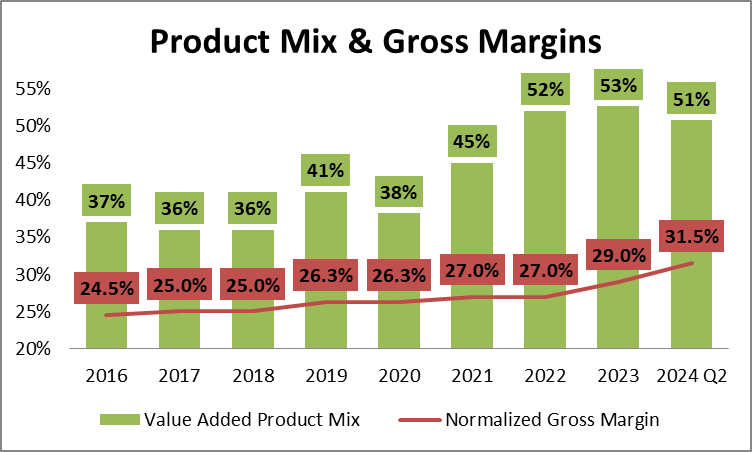

In that sense BLDR has focused over the years on expanding its manufacturing capabilities and the value-add side of the business, with better margins and returns on investments:

As it can be observed, the Company has been able to steadily improve its business mix increasing the sales of value-added products and expanding its margins, and especially its normalized gross margins that are those that try to eliminate commodity price fluctuations and abnormal business dynamics (e.g. multifamily business in the post-COVID era) and that provide a more realistic view of where gross margins will potentially stabilize. This trend is expected to continue in the future as is the growing use of value-added components in the homebuilding process within the residential new construction market.

6. Strong FCF generation and disciplined capital allocation

The Company has historically demonstrated its capacity to generate strong free cash flow with cash conversion of around ~100% of Net Income:

Besides, as it can be observed zooming in the Great Financial Crisis period, BLDR’s cash-generating capacity is rather counter-cyclical, being the Company able to release large amounts of working capital during the challenging moments of the economic cycle and making the business much more resilient.

Additionally BLDR is a low capital intensive business with limited reinvestment requirements (1.5% to 2% of sales), which leads to strong free cash flow generation.

In terms of capital allocation the Company follows a disciplined approach where it prioritizes maintaining a strong balance sheet, with a demonstrated ability to reduce debt and to return to its target leverage ratio (of 1.0x to 2.0x); reinvest in the business with growth investments; keep its tuck-in M&A strategy; and finally return any excess of capital to shareholders (opportunistic share repurchases).

7. Successful M&A strategy

Since the very beginning one of the main levers of BLDR’s growth strategy has been its M&A activity. The Company has been able to successfully acquire and integrate more than 60 companies since it was formed in 1998.

BLDR has pursued strategic acquisitions based basically in two objectives:

Expanding its value-added offering, by acquiring companies that manufacture prefabricated components.

Broadening its geographic reach, by acquiring leading distributors in new markets and subsequently extending their product offerings (cross-selling) and adding manufacturing facilities.

BLDR has been always a supporter of an M&A strategy “at the right multiple”, claiming that it is often more efficient than the “build strategy” as it “gets you into the market quicker plus you're not adding capacity into a market which can be difficult and create some real pricing war”. “Greenfielding is just getting harder and harder these days with all the restrictions and permitting requirements and it's just taking longer and longer to get buildings out of the ground”.

Besides the Company has a “demonstrated ability to successfully integrate, cross sell and create operating synergies”. BLDR is able to embed its capabilities in its acquirees’ operations, filling their gaps and simultaneously taking advantage of acquirees’ geographic coverage and customer relationships. This performance, reputation and scale have positioned BLDR as the buyer of choice within the industry, where smaller operators come when they are looking for an exit strategy.

Despite the intense consolidation activity within the industry in the last years, the market remains highly fragmented and the Company believes that there are still 1,000+ independent operators in the US that could be considered potential opportunities for tuck-in acquisitions.

In that sense BLDR, with a strong balance sheet and financial flexibility, is well positioned to take advantage of this situation and expects “to invest $500 million in M&A per year on average for the next several years”.

8. Digital strategy

The Company is increasingly pushing its digital strategy forward, developing a digital platform that provides builders with tools for estimating, designing, and managing projects, helping them “finding all the problems in the digital world instead of at the job site” and driving “tremendous efficiency gains”. These tools are designed for builders of all sizes, but especially for those that are not willing or don't have the capacity to invest in technology for themselves, and are expected to enhance the customer experience and strengthen the company’s value proposition by integrating more deeply into the builders’ workflow.

The Company seems to be on track in terms of implementation, with the first years focused on completing the technology and now starting to reap the benefits with an expected $200 million of incremental sales in 2024 and with the goal of gaining an incremental $1 billion in sales by 2026.

Medium-To-Long-Term Tailwinds

Before starting with this point, I just want to state that, in order to not extend excessively this article, I will just comment briefly on these sectorial tailwinds and uncertainties, leaving for a separate article (probably to be published next week) a more comprehensive deep dive on these issues. Being said this let’s start with the medium-to-long-term tailwinds.

Apart from all the positive aspects commented in the previous paragraphs, which mainly refer to the Company itself and its competitive advantages, there are many other long-term industry trends that invite to be optimistic with the housing industry and specifically with BLDR’s future:

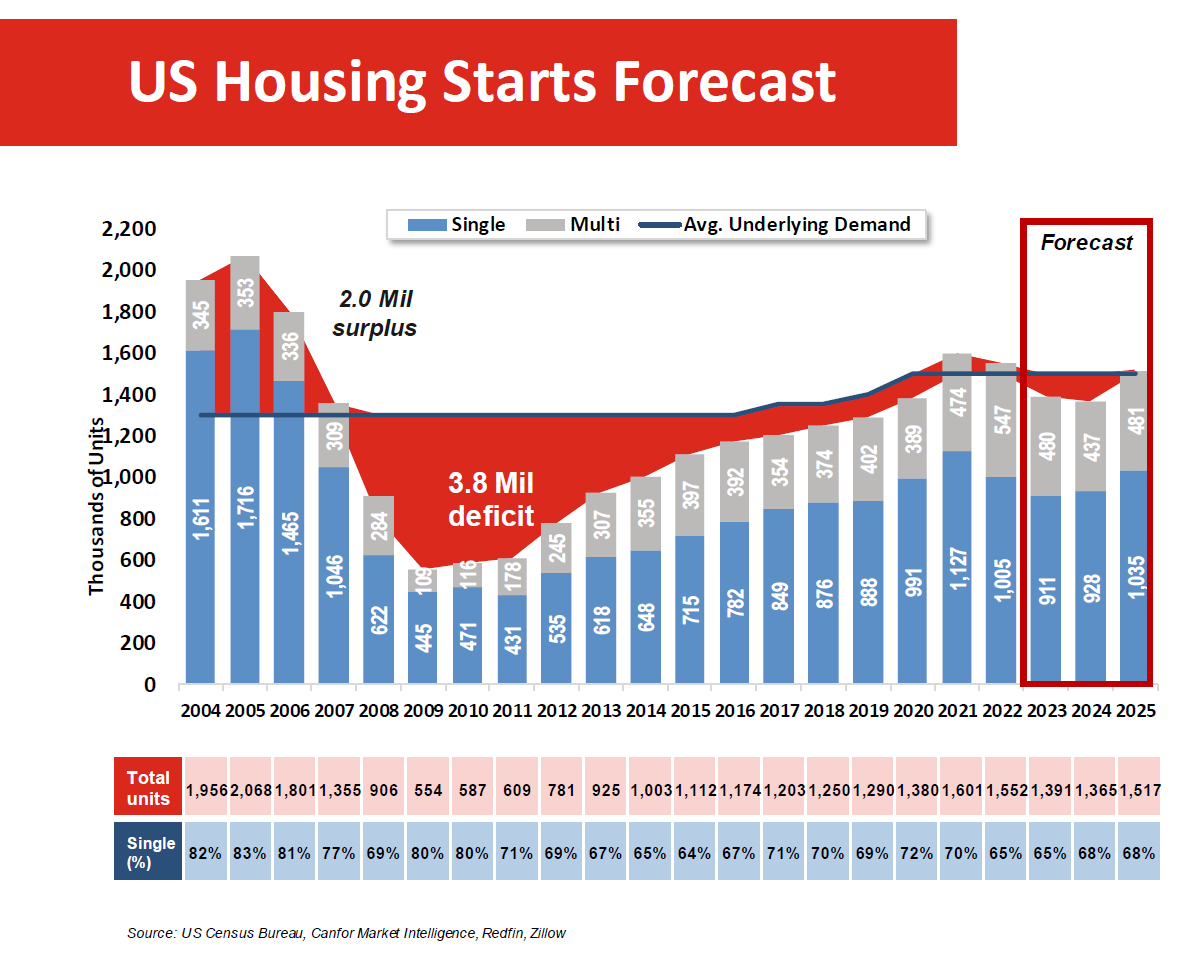

Housing inventory deficit

As commented in one of my previous articles (UFPI), there is a clear housing deficit as a consequence of the significant underbuilding over the last years. This situation has been intensified by “homeowners who locked in low mortgage rates during the period of historically low rates” and that “remain reluctant to sell due to rate increases, intensifying the current housing shortage”. In that sense “demand for housing in the U.S. continues to outpace supply, necessitating substantial investments in new single-family home construction” and at some point new construction will have to fill this gap.

Aging housing stock

“The US housing stock is older than at any time ever recorded”. The average age of US homes is over 40 years old (up from 27 in 1991) and 80% are over 20 years old. There is a growing need to invest in the existing housing stock that is expected to fuel repair and remodel activity.

Favorable demographics support housing demand

Young generations (i.e. Gen Z and Millenials) are the largest population cohorts and are entering peak household formation years. The entry of these population groups in their period of greatest homebuying are expected to positively influence the construction market.

Record levels of home equity

Significant home equity supports higher levels of remodel activity and “homeowners are sitting on record levels of home equity as home prices and values have remained strong”. It is estimated that “homeowner equity stands at a staggering $31.8 trillion currently, which is nearly $12 trillion higher than pre-COVID levels” and this means that “the scale of tappable equity is enormous”.

Accommodative monetary policy

Being true that it will take some time to really perceive the impact of a sustained mortgage interest rate relief over homebuyers behavior, estimated interest rate declines are expected to positively impact home sales in the medium to long term.

Healthy labor market and labor shortages

Labor market may have a twofold positive impact over the housing industry. On the one hand, one general aspect which is the positive impact that a healthy labor market has over housing demand and household growth.

On the other hand, one specific aspect in relation to BLDR which is that skilled labor shortages will keep “creating opportunities for products that reduce job site labor requirements and improve efficiency”. Those suppliers (like BLDR) able to comply with performance requirements while simultaneously take care of install or build tasks will probably capture market share.

Short-Term Uncertainties

While the medium-to-long-term perspective is rather optimistic, it is important to recall that there are some uncertainties in the short-term that could affect the industry and the Company:

Post-COVID normalization

The period 2020 – 2022 created many abnormal dynamics that are now returning to more normalized levels: gross margins returning to more normalized levels, multi-family pulling back, remodeling activity slowing down after demand pull forward... All those aspects could negatively affect the housing industry and the Company in the short-term until the industry reaches a new balance. Indeed the Company has recently updated its 2024 full year outlook with sales and margins slightly below its 2023 results.

Affordability challenges

In relation with the abnormal dynamics mentioned in the previous point, the lack of supply (among other factors) has led to stubbornly high home prices. Despite some moderation, “single family home prices remain significantly higher than pre-pandemic levels, forcing many buyers to sit on the sidelines”. If we add to these persistently high mortgage rates, increased cost of insurance and property taxes and broad-based inflation issues, the result is a housing affordability problem. Until those factors affecting affordability start to reverse, affordability will remain being an issue.

Increasingly consumer cautiousness

There is an overall general sense that buyers are becoming slightly more cautious about purchasing a new home in the near term. Factors like the uncertainty about monetary policy cadence and how fast (or slow) it will affect mortgage rates; November US presidential elections; or recent jobs reports are all increasing short-term noise and causing some potential buyers to stay in the sidelines.

Market incrementally weaker

All those previous factors seem to be leading to some sort of market deceleration. Many companies have reported that this cooling off has accelerated in the second quarter of this year, with slower demand sales pace and lower traffic. However, all those companies also report that they expect this to be a temporary adjustment with no impact for the many tailwinds in a longer time horizon.

Valuation and Final Thoughts

BLDR is currently trading at ~17x P/E (Fwd) and ~10x EV/EBITDA (Fwd), and rather close to its highest multiples of the last five years and above its historical averages:

In that sense, the current valuation invites to be initially cautious. However in order to have a more comprehensive perspective, let’s compare with other specialty distributors:

As it can be observed, the Company is currently trading below this group’s average. However this is a rather heterogenic list of companies where the most comparable ones are those in the bottom part of the chart (which are the ones more closely related with the residential homebuilding construction sector like BLD, BXC, UFPI, GMS or BECN). Compared with this more reduced group, BLDR would be trading rather in line with its peers (or even slightly above). In any case it doesn’t seem to be extremely under or overvalued compared with them. However the Company has been steadily increasing the quality of its business, with increasing focus on value-added products, structurally-higher margins and reinforced pricing power, and nowadays might be approaching to the quality of the top-performing companies within this list:

Well, then what is the conclusion? In my opinion there are two different ways of looking at this company (and let me be completely clear that is not at all an investment advice and each one should make his/her own research). The first one is to wait for more attractive entry points. As commented throughout this article, there are some uncertainties that could affect the company and its sector in the short-term. Additional sales deceleration, delays in monetary policy adjustments or longer lags for these adjustments to affect the residential homebuilding sector are just some examples of negative surprises that could lead to some correction. The sector seems to be pricing for no surprises and this is often the moment to be more careful. The risk of this approach is to try to time the market: one could never find those entry points or even be unable to start buying when the correction has become a reality.

The second one is to think with a longer term perspective. While the current multiples are not the most attractive, they are not at all especially stretched for a company of this quality. As commented, BLDR has been structurally improving its quality, enjoys many long-term tailwinds and has much room to keep deploying its strategy. Additionally, in my opinion, there are no specific circumstances that currently could make think that it will not keep thriving in the future. In that sense, should the Company is able to keep growing and improving its margins, these current “not-bargain” multiples are irrelevant for the long term. Besides BLDR is becoming an exceptional company and it would be not strange those multiples to be reevaluated in the future to be more in line with the highest quality distributors, providing some additional upside.

Being said this, now is the time for you to analyze the Company and make a decision.