All of you who have read some of my previous articles know that I love distribution businesses and that, while I do really search for companies in many different sectors, many of those articles are focused on specialty distributors. This time I’ve been able to escape the magnetic pole of distribution businesses and stay on a previous step within the value chain.

UFP Industries (UFPI) is a manufacturer and does not enjoy some of the virtuous cycles and dynamics that distribution businesses create, but has many competitive advantages and tailwinds that make the business really interesting. As we will see, the trajectory and experience of its management team, its alignment with employees and shareholders, its diversified nature, its national reach and scale and an impressive M&A activity, among other things, make UFPI a high quality business and with a valuation far from being stretched.

Is this enough to catch your attention?? I hope so! So let’s get started! But let me first ask for your support. If you enjoy these articles, please consider becoming a subscriber and share with anyone that you think could find it valuable. Thanks!

Business Model

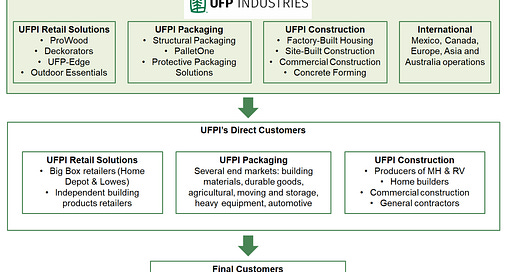

UFPI was founded almost 70 years ago, in 1955, as a supplier of wood-based products to the manufactured housing sector. Since then the Company has been growing its business model and nowadays it has become a holding company with subsidiaries that design, manufacture and supply wood and wood-alternative products to three different markets (retail, industrial/packaging and construction) and globally.

UFPI positions itself in the middle of the supply chain, between a fragmented group of raw material providers and a diversified base of direct customers which include from Big Box retailers, wholesale distributors or home builders to almost any sector with packaging needs. This position, combined with its national scale, enables the Company to develop strategic relationships with its vendors and enjoy a relevant buying power, getting favorable conditions like competitive pricing or access to inventory consignment programs. Besides the diversified nature of its customer base makes the Company to be less exposed to cyclical dynamics and to better overcome the volatility of the lumber market (see next paragraph).

Competitive Advantages

Serial acquirer

While UFPI has been able to grow with a balanced combination of organic growth and acquisitions, it’s undeniable that we are in front of a serial acquirer. UFPI has been able to add and integrate more than 65 companies in the last two decades with approximately $3 billion in annualized sales, and since 2020 has an internal team dedicated exclusively to identify and negotiate acquisition opportunities.

UFPI’s strategy aims to grow through the acquisition of local and regional companies in order to fill in their product lines with new products that can be scaled across its network and to expand its geographic reach. The Company looks for well-run businesses with strong management teams at the helm and that generally stay within the organization after the acquisition to keep operating the business.

Although the company has been improving its market position in all its segments, its main focus has been on increasing its presence in the industrial/packaging sector, with an outsized part of the acquisition growth coming from this sector

Diversified business model

UFPI serves mainly three different segments: retail, industrial/packaging and construction. Those segments are rather evenly distributed and represent approximately 40%, 25% and 31%, respectively (being the remainder 4% UFP International). Historically UFPI was much more concentrated on retail and construction markets (and specifically on manufactured housing) but rapidly realized about the advantages of a more balanced structure and started to increase its presence in the industrial/packaging segment.

This evenly distribution helps UFPI mitigate cyclicality and lumber market volatility. In UFPI’s words, this structure acts as a hedge against lumber market swings and cyclicality, with exposure to cyclical, non-cyclical and counter cyclical markets. Although exposed in many cases to similar factors, retail, commercial or industrial segments have historically followed a different cycle than residential housing and have a more relevant part of the revenue coming from maintenance and repair work. This nature provides a buffer against a housing market slowdown, helping UFPI to outperform in different economic environments.

National reach, purchasing power and distribution network

Thanks to its continuous expansion, UFPI has 219 facilities globally, 196 of which are located throughout the US. Apart from the economies of scale, this geographical footprint gives UFPI the capacity to provide the best customer value as it is able to offer a homogenous product quality all across the covered geographies, which is especially relevant for national and regional home builders, commercial constructors or Big Box retailers. Besides, its expanding scale enables the Company to leverage its cost structure, making the Company much more efficient and profitable as it grows.

Additionally UFPI enjoys an enormous purchasing power as, being one of the nation’s largest buyers of softwood lumber from primary manufacturers, it is able to buy almost the entire production that its mill suppliers produce.

Experienced and aligned management team and employee base

UFPI is a company led by executives who have been running this playbook during a long time. Matthew J. Missad, the current CEO, has held this position since 2011 and joined the Company in 1985 as manager of legal compliance. But not only him: most of the executive officers have been within the Company for more than 30 years (“average tenure of 22.3 years for our 65 most senior executives”) and UFPI prides itself on showing an extremely low senior management turnover.

Besides management team and employees are strongly aligned with shareholders. UFPI requires/incentivizes stock ownership by its executives and employees, and presents different compensation structures which reinforce this alignment:

- An executive compensation program based on return on investment and operating profit and with “greater emphasis on performance-based compensation”.

- A Deferred Compensation Plan which allows key employees to defer a portion of their salary and/or cash incentive compensation and those deferred amounts to be invested in UFPI common stock at a 15% discounted price.

- An Employee Stock Purchase Plan which allows employees to make payroll deductions or lump sum contributions for the purchase of UFPI common stock at a 15% discounted price.

In that sense, “insiders and employees own ~12% of shares outstanding” and executives’ non-at-risk base salary represents the lower proportion of its total compensation in comparison with the companies in its peer group:

Working culture

In close relation with the previous point, Missad’s history reflects very well UFPI’s mentality and culture. While the current CEO formally joined the Company in 1986, he actually started in 1978 doing maintenance work at the age of 16 and UFPI loaned him the money for the law school with the promise to come back to UFPI after graduation. This is the way of working of this Company, which looks for talented people and tries to take care of and promote them, with very high employee retention.

UFPI fosters a “culture that drives personal and profession growth throughout the organization”. The Company follows a results-driven culture where plants operate as individual profit centers and where accountability, innovation and competition are fostered. It is rather telling that since 2016 the Company possesses its own business school, with the idea of giving its employees the opportunity to move up in the organization.

Decentralized approach

UFPI follows a completely decentralized approach, where plants operate as individual profit centers and managers act as owners. Even in the case of acquisitions, UFPI acquisition strategy is based on acquiring well-run companies and letting their own teams to keep building the company, maintaining unchanged as far as possible the management team, the employee base and the day-to-day decision making process.

UFPI’s approach is to let the teams operate their business locally (“local decision-making for local customers”), providing just functional support when needed and leveraging those resources that could be fully exploited more efficiently on a centralized level. This generates high levels of management and employees retention rates and helps building its reputation as the buyer of choice in the industry.

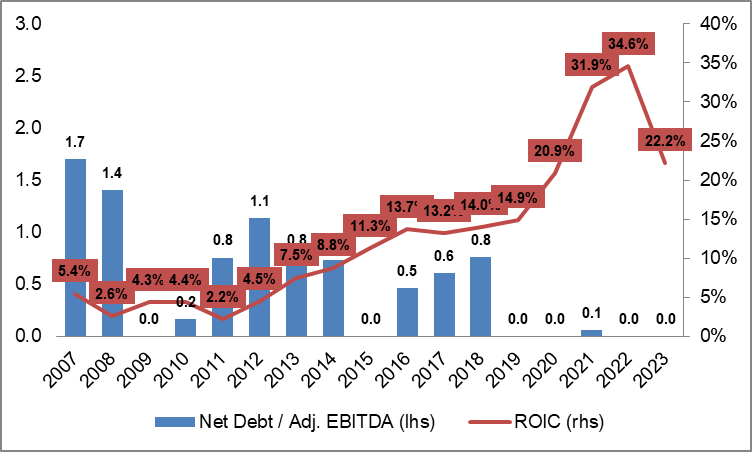

Thoughtful capital allocation

UFPI follows a capital allocation strategy with the goal of maximizing return on investment and “provide the best total shareholder return over the long-term”. In doing so, the Company “pursue a balanced and return-driven approach between dividends, share buybacks, capital investments and M&A”. UFPI distributes quarterly dividends, based on payout ratios and yield, and target share buybacks in “order to offset the effect of issuances resulting from our employee benefit plans and at opportune times when (their) stock price falls to predetermined levels”.

However the Company prioritizes capital on growth, instead of capital distribution. This means basically that UFPI is mainly focused on capital expenditures and acquisitions in order to expand proprietary value-added products and services, market expansion in new markets and consolidation in existing markets.

Financial Overview

UFPI’s financial evolution is rather impressive. Just looking at the last two decades, the Company was making around $1.4 billion in sales in 2000 to reach almost $10 billion in 2022 (now it has receded a little bit to around $7.2 billion in 2023), and this is despite having suffered one of the biggest crises in the US history (i.e. GFC).

UFPI has been able to achieve this success through a combination of new product introduction, geographic expansion (even internationally) and markets diversification. While the Company was initially focused on its retail and housing construction businesses, it has been steadily increasing its presence in the industrial/packaging segment and in other construction areas like commercial and concrete forming. Besides, its strategy has been focused on a balanced combination of organic and acquisition growth, that allowed the Company to rapidly gain market share.

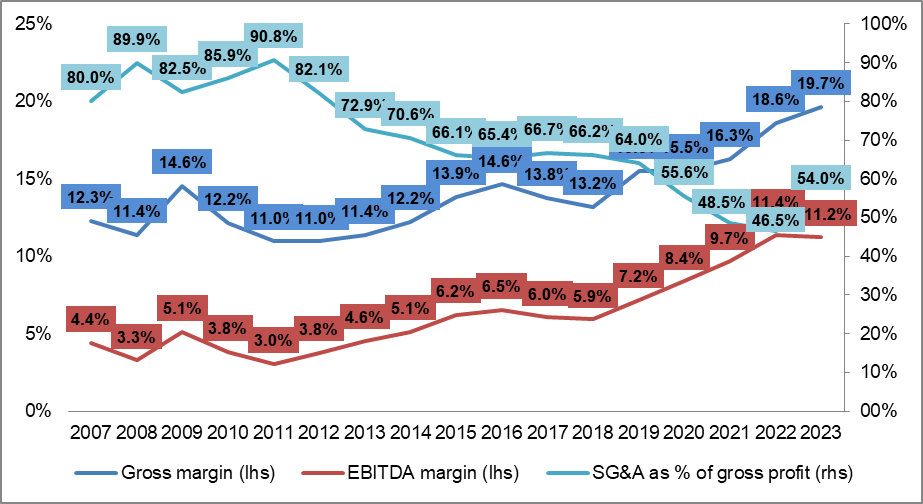

Furthermore, this growth has been accompanied by a notable improvement in its profitability, mainly since the recovery from the GFC:

As commented in the previous paragraph, UFPI has been able to steadily improve its sales mix increasing its sales of new and value-added products and expanding segments like industrial/packaging and commercial construction, which have higher gross margins. Although this profitability improvement has been partially offset by the higher level of SG&A expenses that this kind of products requires and higher incentive compensation, its combination with cost reductions, productivity improvements and operating leverage has allowed UFPI to increase its margins and continuously revise its targets upwards.

Additionally in January of 2020 the Company implemented a new operating structure “re-organized around the markets it serves (retail, construction, and industrial) rather than geography”. This market-focused management structure has allowed, among other things, to speed the introduction of new and value-added products, to better align with (national) customers and to make more efficient the use of resources and capital, contributing to a structural improvement in margins.

Finally the Company has had the ability to reinvest its earnings back into the business at high rates of return, steadily increasing its ROIC levels, and fund all the process mainly with its own operating cash flow. The Company has mentioned that they feel comfortable with a leverage ratio of 1.5 to 2 times debt to EBITDA, but they tend to be close to zero:

Long-Term Industry Tailwinds (and Some Short-Term Headwinds)

Apart from all these positive aspects commented in the previous paragraphs, which mainly refer to the Company itself and its financial evolution, there are many other long-term industry trends that invite to be optimistic with UFPI’s future. We can analyze these industry tailwinds from the perspective of the different segments UFPI caters.

Retail Segment

With regard to the retail segment, the most relevant variable to look at is probably the evolution of home improvement spending. The short-term outlook is not rosy, with declines forecasted in 2024 and 2025: “home remodeling activity continues to face strong headwinds from high interest rates, softening house price appreciation, and sluggish home sales”. Besides Big Box retailers are expecting negative comparable sales for 2024 (-2%/-3% Lowes and -1% Home Depot, after decreasing -4.7 and -3.2% in 2023, respectively).

However while “housing repair and remodeling demand has slowed from recent highs”, “industry analysts forecast it stabilizing near relatively elevated levels through to early 2025” and this current “downturn is poised to be fairly modest and short-lived with market expenditures steadying at near-record levels”.

In the long run there are several reasons to be optimistic as increased home equity levels, median age of existing homes, near-all-time-low supply of homes and the lock-in effect of high mortgage rates are expected to positively influence this segment during the following years and keep expanding building materials sales.

Industrial/Packaging Segment

With regard to industrial/packaging, the Company mentioned in its last conference call that this is the segment where they “have seen the biggest headwinds”, with many of their customers experiencing lower market demand, which means less demand for packaging.

However, longer term, the outlook is again rather optimistic. Industrial wooden and corrugated packaging solutions are expected to continue its upward trajectory as demand for efficient and sustainable solutions across different industries keeps rising. With the transition to a low-carbon economy, there is a growing use of renewable wood-based products and this is having a relevant impact in almost every industry. This situation will probably have a strong impact in a company like UFPI which caters to diverse end-customer markets, “including appliances, light and heavy equipment, agriculture, moving and storage, automotive, furnishings, horticulture and glass”.

Furthermore, “the growth of e-commerce is also contributing to the expansion of the wooden packaging pallets market”. The rise of e-commerce activity is increasing the relevance of transportation and packaging solutions, with wooden pallets being the preferred choice for e-commerce companies. Although some sort of moderation in e-commerce growth in the following years is likely, there are no specific hints that invite to think that it will not keep consistently growing.

Construction Segment

With regard to construction, in the short-term the forecast is a little bit more optimistic than in the previous two segments. Affordability and interest rates remain being serious challenges, but it seems that they are starting to moderate and “industry analysts expect U.S. housing starts to stabilize in 2024 (and) track higher in 2025”.

Besides, from a more long-term perspective, there are again different factors that are expected to keep this segment thriving in the future. First of all, there is a clear housing deficit as a consequence of the significant underbuilding over the last years. It is estimated that ~14 million housing units are needed to meet 2030 US demand and that “over the last 20 years, compared to the prior 30-year average demand, there is a cumulative undersupply of almost 3 million single-family homes”, that some even raise to 3.8 million:

Additionally there are other factors, like the population growth or the entry of Gen Z and Millennials in the peak homebuying period, that, combined with this significant underbuilt within the housing sector, are expected to keep pushing the market upwards in the following years, especially if interest rates begin to ease.

Also with regard to commercial construction and concrete forming, there are many favorable trends that are expected to provide relevant tailwinds to the sector: the increasing demand for lumber used in non-residential construction; de-globalization or on-shoring processes; warehouse and distribution centers development; or the need for infrastructure improvements and favorable legislative actions (e.g. Infrastructure Investment and Jobs Act, Inflation Reduction Act, CHIPS Act, etc.). These are just some examples of the many tailwinds that can positively impact the non-residential construction spending and stimulate wood-products demand.

Final Thoughts

As commented throughout this article, there are some uncertainties in the short-term that could affect the company: home remodeling spending is under pressure, industrial/packaging customers are experiencing lower market demand and construction is still stabilizing within an unfavorable macroeconomic environment. All those factors invite to be a little bit cautious in the short run.

However, from a longer term perspective, this is a company with many tailwinds and with much room to keep deploying its strategy. In my opinion, there are no specific circumstances that could make think that this company won’t keep thriving in the future.

Besides the Company is currently trading at around 7.5x EV/2023EBITDA. I do know that this multiple could be a little bit distorted as a consequence of pandemic-induced dynamics that might be still reverting back to more normalized levels and that UFPI is guiding a 2024 “slightly” worse than 2023. However its five-year strategic plan sets targets for sales of over $10 billion and 12.5% EBITDA margin, which would imply a multiple of less than 5x. Acknowledging that management goals should be taken with a grain of salt, this is company with a good track record of achieving those goals and continuously increasing its targets, and, in any case, those multiples seem to be far from stretched for a company with such an exceptional management and the quality of its business model.