Arhaus ($ARHS): why I passed on or the importance of the “little things”

In Praise of the Proxy Statement

Introduction

This article was expected to be a normal investment thesis but finally it has become a praise of the Proxy statement and the importance of reading each and every document about a company before making a decision.

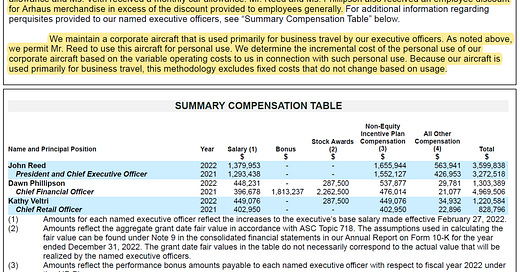

I have to admit that the analysis of ARHS has been a rather disappointing journey. There are many many things that I like about them, but I found some “little things” that finally made to decide to move on. I spent many days trying to understand the company, the sector, the context… everything. As I will explain, despite there were some concerning issues, in general terms the more I analyzed it, the more I liked. However at the end of the journey, hidden within the Proxy statement, I discovered some aspects that made me reassess my positive opinion about the company. As you will see, those aspects might be considered “little things” by many, but in my opinion in many cases the devil is in the details.

Keep reading with a 7-day free trial

Subscribe to JustValue to keep reading this post and get 7 days of free access to the full post archives.