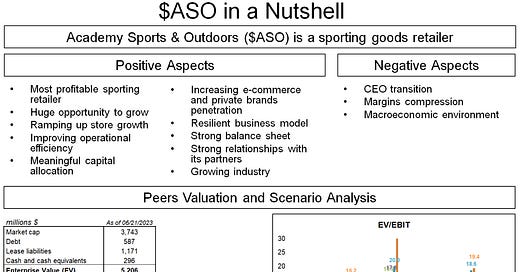

Despite 1Q23 disappointing results, ASO is doing everything right to thrive in the long run: ramping up its store growth, deploying a meaningful capital allocation, working on operational efficiencies, increasing e-commerce and private brands penetration…

The Company is outperforming its peers and presents structural characteristics that confer with a resilient business model in case of a downturn.

There are some negative aspects that deserve to be highlighted (CEO transition, potential margins compression and consumer discretionary nature) but not enough to derail ASO’s outperformance.

Within my base case scenario the upside might be 140%+ within a five years horizon, but if ASO were able to achieve the ambitious goals stated in its last Investors Day, they could multiply by many times.

Revisiting Academy Sports and Outdoors

A year ago I wrote an article about Academy Sports and Outdoors (ASO) where I detailed why I liked this company so much. At that time the company was trading at $38 a…

Keep reading with a 7-day free trial

Subscribe to JustValue to keep reading this post and get 7 days of free access to the full post archives.