Do Stocks Always Outperform In The Long Run?

The Misinterpretation Of Jeremy Siegel’s Chart

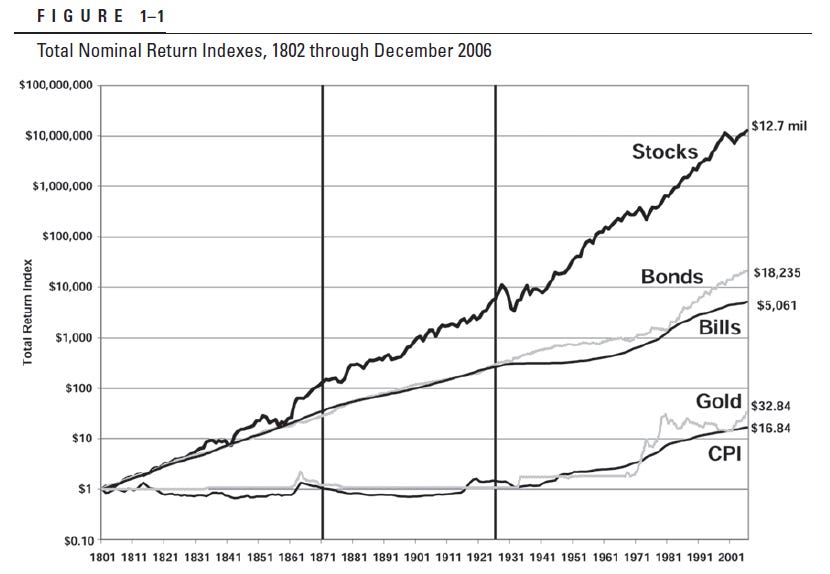

I have recently read the article “Do Global Stocks Outperform U.S. Treasury Bills?” (by H. Bessembinder, T. Chen, G. Choi and K.C. J. Wei). This interesting article made me re-think about one of the most, in my opinion, misleading dogmas about investing: stocks always outperform in the long run. To the spreading of this misleading statement has broadly contributed the general misinterpretation of the famous Jeremy Siegel’s chart (included in his book “Stocks for the long run”):

First of all I would like to make clear that I profoundly admire Jeremy Siegel and his contribution to the investment world. It is not the point of this article to discredit him (I couldn’t discredit him even if I wanted to). Indeed Siegel’s chart is of course perfectly correct and the abovementioned Bessembinder et al.’s article is in line with the chart in the sense that it s…

Keep reading with a 7-day free trial

Subscribe to JustValue to keep reading this post and get 7 days of free access to the full post archives.